CEOs & Boards – FTX, Twitter, Disney

Nobody seems to look closely at company leadership and oversight until things go wrong. The three biggest stories of the past week – FTX’s collapse, Elon’s first days with Twitter, and Disney’s CEO switch – highlight just how bad things can go when there aren’t proper checks.

FTX – Poor diligence followed by worse oversight

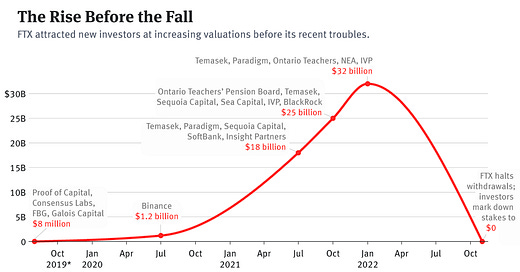

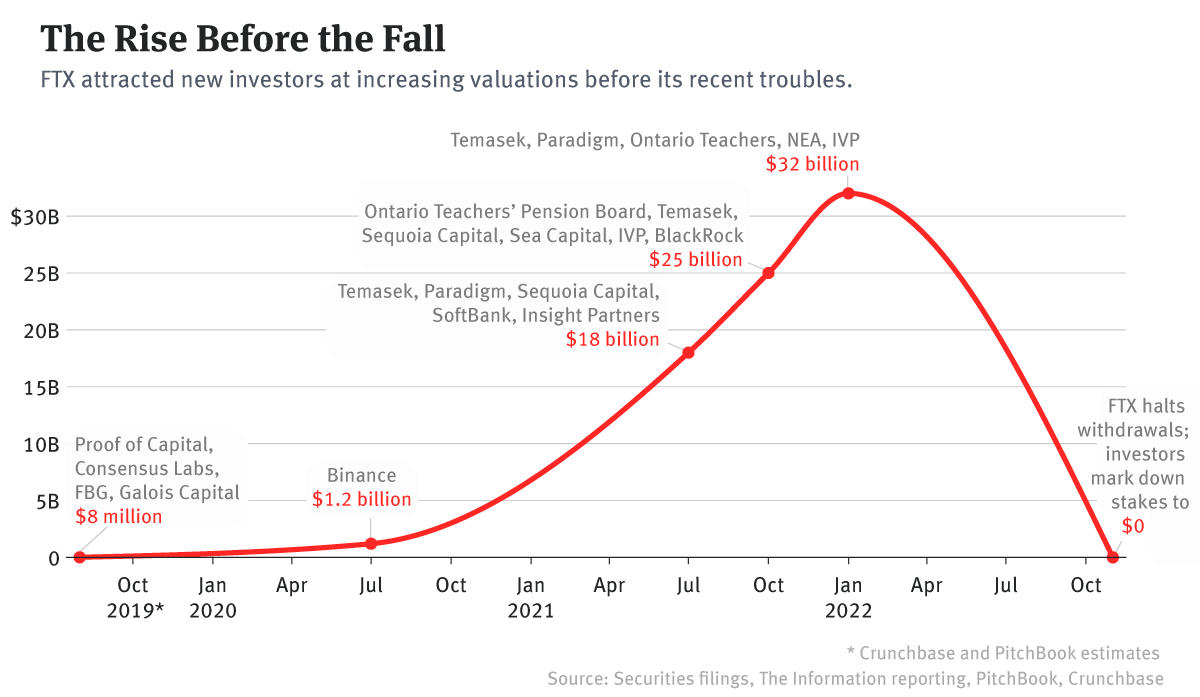

Background – Founded in 2018, the crypto trading platform took off when it basically went from Seed to $1.8B Series B and saw the valuation 27x in <18 months. Somehow, the fall was even faster.

Investment rationale

Perhaps because few people will admit to not understanding crypto, much of the company’s value was tied to its founder, Sam Bankman-Fried. He was a VC-ordained wunderkind that the world ascribed value/respect/prestige to because the VCs did.

Lack of diligence was the original sin

Lots of VCs talk about investing in the person, not the business. In addition to being batshit justification for bias (worse than companies preferencing “culture fits”), it’s a cop out to doing diligence.

The text below reads like excerpts from leaked text messages. It’s not. This is what Sequoia posted on their own site while still celebrating their investment, titled: “Sam Bankman-Fried Has a Savior Complex—And Maybe You Should Too”.

It says a lot both about what they looked for in diligence and valued in a founder: someone who was articulate, nerdy, smart/cocky enough to play video games while raising $1B. Are those really the skills a CEO relies on every day?

But lack of oversight led to damnation

The counterargument is that early-stage investors have little to go off other than talent. For that reason, I put more of the fault here on their lack of oversight than on their lack of diligence. According to the company’s new CEO, the court should not view the (audited!?) financial statements as “reliable”. That’s crazy – the Board wasn’t even getting reliable information, should they have wanted to conduct oversight.

Founders have outsized power. Lots of people point out the weighting of voting power, especially at Facebook. But it’s not about votes where the founder overrules the Board. It’s that we deify these founders. Who can speak up against them? Their Board members are usually significantly inferior (in wealth/status/power). Compare the CEOs to their directors at GE or Apple and consider how different that dynamic might be from that at FTX.

The result: FTX appeared to fall quickly because that’s what we saw. But the Board should have known this was coming a long time ago.

Broader trend

What is most disturbing is the echoes of recent high-profile failures. I thought after Theranos that investors would start doing real diligence. And after WeWork stumbled, that Boards would stop writing blank checks to founder/CEOs.

These were all founder-led companies with generational talents. When you invest in the person, not the business, why would you need to do any oversight?

Why FTX might be different

I suspect the VC world ignored those prior examples because they didn’t respect the investors/Boards. They blamed Theranos on the less-sophisticated angels / non-tech Board and blamed SoftBank’s Masa individually for WeWork.1

But Sequoia, a/the top VC, is unfortunately getting a lot of the blame for FTX. Their failure should make every VC and Board question themselves.

I can’t possibly imagine another chat exchange like Sequoia’s or a Board as hands off as FTX’s was.

Twitter – A mad man with even less oversight

People disagree on whether Twitter has influence: It has 436 MAUs (15th social media platform overall, fewer than Pinterest) but 6.9B monthly visits, more than Instagram. Regardless, it’s probably the most influential company to be run without any oversight.

Business future

People also disagree on whether Elon is a genius. They say there is “no accidental billionaire”, so what does that imply for someone worth $150B+?

But no one bats 1.000. And even if Elon can turn the company around, I can’t see a path in which the last month has made that easier. It’s going to be a very long road back to the $44B he paid, but then again, Elon operates on long timelines: SpaceX was founded in 2002, Tesla in 2003.

Benefits of being private

It also seems increasingly likely that making money is not his priority. Not only is Elon not beholden to a board, meaningful investors, or employees – he doesn’t even concern himself with customers/revenue. He has full license and (potentially) ability to do whatever he wants.

There are benefits to being private – from Elon’s perspective. First, he can make long-term (painful) changes without shareholders removing him. Second, he can prioritize goals other than profit.

I firmly disagree with/am disgusted by everything Elon is doing, but would champion a moral CEO who puts much of his wealth behind a mission-driven endeavor.

Disney – Proving the value of a good CEO?

Bob Iger led Disney for 15 years. In 2020, he selected his head of parks, Bob Chapek, to take over. On Sunday, the Board removed Chapek and reinstated Iger. He now has two more years to find a successor and non-zero chances he extends beyond that (even at the age of 73).

More Board failure

In June, the Board gave Chapek a three year extension. Less than a few months later, the CFO led a revolt with support from other executives.2 First, how did the Board have such a different opinion of Chapek’s abilities from the people who worked with him daily? Second, how did they not know how those people felt? The mistake will cost them $23-$54M for Chapek’s payout.

CEO compensation

I share most people’s skepticism about CEO pay packages, and Iger was one of the best compensated: more than 1,000x the average employee and enough to get Abigail Disney (Roy’s granddaughter) to call it “insane”.

Are these CEOs really worth more than the next best (cheaper) alternative? Are they worth more than 1,000 junior employees? But Iger and Chapek arguably offer a good A/B test.

Iger is expected to make $27M this year. But on Monday, news of his return boosted Disney’s stock price 6% at close – or $9.8B in market cap.3 Or for another point of comparison: Iger’s net worth, after 45 years at Disney/ABC, was estimated at $690M in 2019, arguably a fraction of the value he delivered/oversaw being delivered.

Maybe the skills needed to be CEO of Disney are super rare – more like being the New England Patriots quarterback and justify similar “insane” compensation.4

Picking a successor

I’d argue picking a successor is one of the most important things a CEO does. What’s the point of doing all that work just for someone to throw it away?

Iger reportedly tried to leave several times but struggled to find a successor – failing to get Tom Staggs there and arguably leaving himself with no great options (Bob Chapek beat out Kevin Mayer and others for the job – we’ll never know who would’ve been best).

Disney’s stock today is trading at the same price as at the end of 2015. In 33 months, Chapek erased five years of the value Iger helped deliver to the company.

It’s particularly important for founder-led companies: consider how Amazon, Microsoft, Google, and Apple have fared. In a subsequent post, I’ll write about the Tim Cook era and a new book, “After Steve”.

Quick counter argument :)

Chapek faced headwinds that Iger did not: streaming wars, content costs, complications from the Fox deal. Could he really have done better? The stock already heavily regressed today from its open +10%. I wouldn’t be shocked if it fully reverts to Chapek levels.

TK at Uber has nuance in my opinion. The company didn’t collapse. It wasn’t fraud or failure. In fact, it was widely-regarded as the best private company at the time. It just had a toxic founder who was given too many passes by a Board (albeit some of the best investors) blinded by the financial successes until character risked that.

There are already details emerging about Chapek’s missteps, and more will come – likely only making the Board look worse.

For comparison on Iger’s compensation, Disney trades at 15x NTM EBIT.

Tom Brady is a fun comparison. His time in the NFL closely coincides with Iger’s leading Disney. No one can accurately estimate Brady’s net worth, but he has made $333M in his career, including $30M last season – very close to Iger’s pay. And, like Iger, he’s tried to leave multiple times. But Brady also makes a lot off of sponsorships, including…FTX.