Apple Part 2: Jobs vs. Cook

Aside from both having common noun names, Jobs and Cook don’t have much in common: very different business models (for a company that is also a common noun). How do they measure up?

Last week, on “Izzy’s”...

Part 1 summarized the differences between the two CEOs of Apple: Jobs was a designer who built incredible hardware; Cook is an operator who streamlines the money-making factory. The company needed/got different management for a different stage of life.

The rebellious, LSD-taking, Birkenstock-wearing teenager has grown up into a reserved businessman who says shit like, “inventory is evil”.

“Taking LSD was a profound experience, one of the most important things in my life.” — Guess which one said it

This week, on “Izzy’s”…

There is always uncertainty when the first CEO leaves. Was the founder the only person who could run the company or is it in a new stage requiring a new leader? Apple was not given a choice.

My goal here is to compare the two incomparable CEOs: What did they do and who ran Apple better?

I’ll start by reviewing why Cook prioritized Services over Products…$$$

Then I’ll evaluate how disruptive (or “good”) Cook’s Services are. (Spoiler alert: no one loves Apple Music.)

We’ll then try to unpack how, if its Services are mediocre, Apple is the largest company in the world. Answer: The most-loved consumer brand has gone B2B with ads and fees.

The Apple Tree’s Branches

Apple has dozens of revenue streams that it organizes under two businesses:

Products, broken out by iPhone, Mac, iPad, and Wearables/Home/Accessories, and

Services, without disclosing segment detail. It was originally just iTunes. It now includes AppleCare, Cloud Services, Digital Content (Music, News, Arcade, Fitness, TV), Payments (Wallet, Pay, Card), and…Advertising/Licensing.

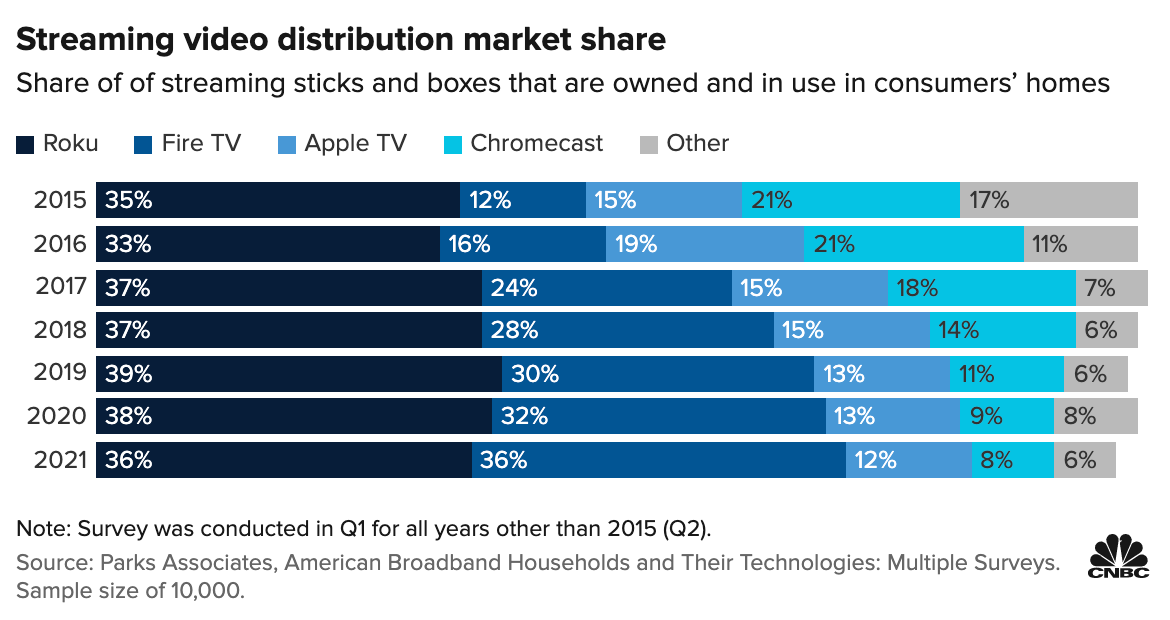

Steve Jobs, as you might have heard, was all about the former. From his return in 1997 until his death in 2011, he launched revolutionary consumer products and one revolutionary service, iTunes. (Also the less revolutionary TV, maybe because it was 13 years before THE STREAMING WARS.)1

Services

When Cook took over in August 2011, there was concern that Apple was running out of room in the then-$800B consumer electronics market and would also see its margins contract. And they have: Product gross margins have dropped from 44% to 36%.

So Cook has prioritized Services, which have grown faster than Products and with 2x the gross margins.

In doing so, Cook could claim that Apple was pursuing a total addressable market (TAM) 20x larger than electronics:

Cars – $11T including AV/freight/taxis

Healthcare – $7T

Payments – $2T

Video Streaming – $0.4T

Video Games – $0.3T

Music Streaming – $0.04T

Other (Cloud Storage, News, Podcasts) – Small today, big tomorrow?

I think referencing TAM is kind of BS (especially that cars number from Tesla-backers), so instead consider the market cap of the biggest companies in these industries:

Apple won’t replace these companies tomorrow, but considering what Tesla, Netflix, PayPal were able to do in two decades starting from 0 – Apple could look very different in 2040.

And boy has Cook tried. When he took over in 2011, Services was 8% of the business. It is now 20% of revenue, ⅓ of gross profit – larger than Mac, iPad, and Wearables/Home/Accessories – smaller only than iPhone.

What’s he Cooking up?

Services generates $78B of revenue. What are we paying for? Given the success, it must be great, right? Here is what Apple has launched under Cook:

All due respect to the smart/kind/well-fed2/well-rested people who built these products: I don’t think they’re revolutionary. I think Apple has basically matched what other companies had already done – nothing like what they did with iPod/MP3 players or iPhone/Palm Pre.

So why are they so successful? Because of the synergies between hardware and software — pre-installation, familiar interface design, use across multiple devices.

Jobs knew this decades ago. Per a JP Morgan report from 2004:

“The iPod was fairly successful in its early years, but rapid growth came with Apple’s groundbreaking launch of the iTunes Music Store in April 2003….

Although the number of songs sold through iTunes has generated quite a bit of press, the real news is its impact on iPod, which have increased nearly 20-fold since the launch of iTMS…The immediate popularity of the iPod-iTMS bundle is largely due to Apple's seamless integration of the two products.”

Take a look at this chart of iPod sales and guess when Apple launched the iTunes Music Store.

Is there any money in it?

Okay, now that everyone agrees that Keith Hernandez should be in the Baseball Hall of Fame and that Cook’s software is mediocre but very successful: How exactly is he making so much money off them?

There are two ways: 1) charging consumers (subscriptions for TV+, News+, etc.) and 2) charging developers/content providers/other third-party companies (fees/ads).3

Some of this is tech development (like Apple Pay) and some of it is a change in consumer behavior. Apple isn’t revolutionizing the business model, but it is capitalizing on trends led by Netflix, Spotify, Peloton and Google and Facebook.

It’s not what you look like, it’s what you do

Mediocre software, vanilla copycat business model – still wondering why Apple is a $2T+ company? Here are some reasons.

Advertising

This is dirty shit that I’m not sure Jobs or Ive would’ve come up with – though, then again, Ive is a Knight of the BRITISH EMPIRE.

In April 2021, Apple changed its privacy policy so that users had to opt in to share our data with each app developer. With no incentive to do so, other than to help the lovely people at Google/YouTube, Facebook/IG, Snap, Twitter, most of us (84%) declined.

With less information, their ads became less effective. Meta said it would lose $10B of revenue the next year. Snap’s stock is still down -80%.

Having made space for itself, Apple ramped up its own advertising, selling premium placement in its apps (News, Maps, etc.). But analysts estimate the vast majority of ad revenue comes from the App Store (“Search Ads”): roughly $5.3B in FY22 (ending September), more than Snap and expected to grow to as much as $20B by FY25, per Evercore.

“It’s like Apple Search Ads has gone from playing in the minor leagues to winning the World Series in the span of half a year,” said Alex Bauer, head of product marketing at Branch, in 2021.

Just take a look at this crazy inflection in Spring 2021: Apple Search Ads are now driving 60% of app installs. It is a double win for Apple: It gets paid on the ad and gets paid on the install.

My absolute favorite thing that Cook has done: He sold rights to be the default Safari and Siri search. Since 2018, Google has paid Apple $8-12 BILLION per year. Google calls it “traffic acquisition costs”. It is an ad, and it is insane. It comes at no cost to Apple. At the company’s 20x EV/EBIT multiple, the Google deal is worth $200B of Apple’s market value, larger than Nike or Disney.4

The downside for Apple? Until 2017 it had sold those rights to Microsoft’s Bing – might be kicking itself in the A(I)ss now.

App Store Commission

In addition to the App Store Search Ads ($5B rev.), Apple takes a commission on all in-app digital purchases/subscriptions. Jobs included this fee from the start — he saw it as covering costs, not delivering profit. But under Cook, the App Store has 30B annual downloads with 900M subscribers.

US Apple customers spend more than twice as much on App Store purchases as they do on Apple hardware. Cook is capturing it: $23B last year, 29% of Services.

Music

Don’t forget that Apple revolutionized music first.5 iTunes digitized CDs into MP3, and the store sold songs individually, profoundly changing how artists produced records.

Apple launched subscriptions in 2015 and, despite what you thought, already captures 16% of paid streaming; Spotify (founded 2006) has 32%. Analysts estimate that with 92M subscribers (<10% of iPhone owners) paying $5/month, the business delivers $5.5B of revenue.6

Apple TV, TV+, Studios

I don’t want to twist my ankle in this rabbit hole, so I’ll largely jump over media content. On quality: Apple has the reigning Best Picture (CODA), the first for a streaming service, and the reigning Outstanding Comedy Series (Ted Lasso). Though it also has Selena Gomez: My Mind & Me.

It is rapidly expanding into live sports with Friday Night Baseball and now MLS exclusively (beating out (or outspending) Disney/ESPN, Fox, Univision, Amazon).

The scale?7 Apple TV+ has roughly 25M subscribers (excluding promotions) charged $6.99. Netflix is 15x larger, 200M paying $13 on average. Apple has plenty of room to grow, but $2B/year is a good start.

Payments (Pay, Wallet, Card, Pay Later, Savings Account)

Lots here, and Apple wants it all. In fact, no one else does all that Apple does…

… and only one company (Visa) does it bigger.

But revenue is still very small, and there have been delays on newer products (Savings, Monthly Installments). The Apple Card reportedly cost Goldman $1B last year. Not much detail given, but rarely a good sign for either partner.

Both products charge the business (merchant or bank), not the consumer. Thus far, revenue from these is estimated to be only $1.3B ($829M from Pay, $448M from Card), but JPM estimates $4B by FY26.8

(Quick reminder that these are still huge revenue numbers for new businesses, only small relative to Apple, $400B revenue last year.)

Others

News – This one is cool because, like it did with iTunes/music and TV/Jennifer Aniston, Apple is revitalizing a struggling industry. There are only 25M newspaper subscribers in the US, yet Apple News has 100M revenue-generating MAUs. This year they will generate $2.2B in revenue, half from subscription and half from…ads. That is just below NYT revenue last year, $2.3B.

iCloud – I couldn’t find anything about its size. Given the prices are low ($10 for the max, 2TB), I think it’s probably not that big…yet. What if Apple someday offers devices with tiny storage, the ol’ “remove the headphone port so they buy AirPods” play.

Health – For now, Watch is just another wearable. But the company recently had a breakthrough with a noninvasive glucose monitor after 12+ years of work. Roughly 1 in 10 Americans has diabetes; they would no longer need needles or patches. It’s years away, so how meaningful is it? Shares for Dexcom and Abbott were down -3% on the news (then recovered). From the description, this development sounds as much hardware as software, but it’s all tied together.

Siri – It is the most used (34% of Americans have interacted with it in the past year, compared to 32% for Alexa and 25% for Google Assistant), but I don’t think anyone loves it and can’t imagine an attributable revenue uplift.

Apples and oranges (if you read this far, you’ll stick with me through that joke)

Okay, so Services makes a lot of money from a bunch of software/content/ads.

That is profoundly different from most of what Jobs did. Which CEO has been a better steward of the company?

We could defer to Eve Jobs, but I’ll instead look at the financials.

Jobs grew revenue more than 2x faster, but, to be fair, the company was earlier stage then and had huge TAM to go after.

The two were closer on stock price performance through their first 11 years, but there are a lot of external economic factors on 2011 and 2023.

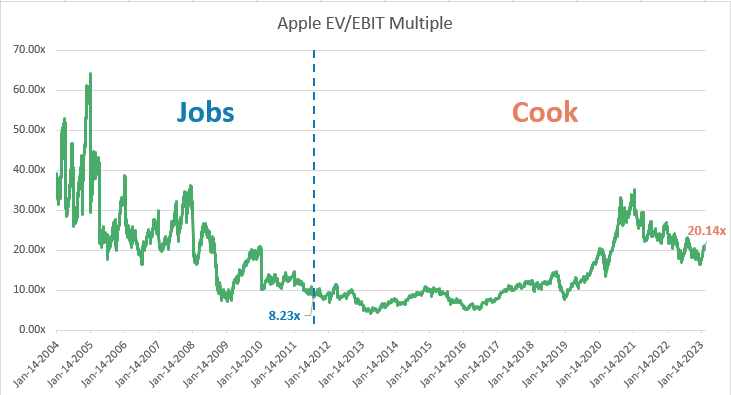

Also, Cook benefitted from multiples expansion: EV/EBIT went from 8.2x to 20.1x. Put another way: most of Cook’s stock price growth came from multiples expansion.

But, you ask, “doesn’t Cook deserve credit for that? Doesn’t the price today, a decade after Jobs, reflect shareholders’ confidence in Cook?”

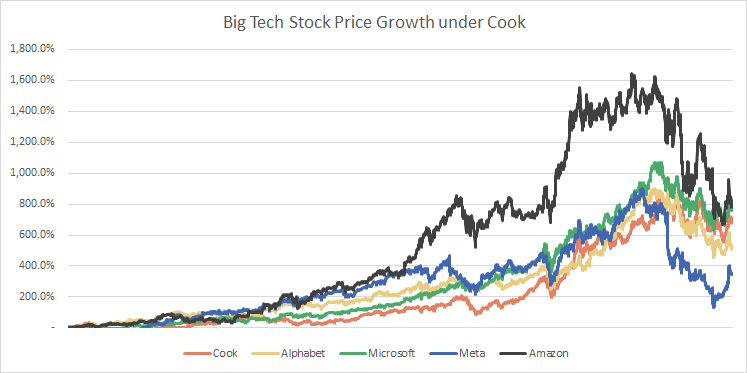

There is no counterfactual for Apple, so let’s instead compare it to the rest of Big Tech. Since Cook took over (actually since FB went public in 2012), Apple stock price has grown almost as fast as Amazon and Microsoft and faster than Alphabet or Meta.

Moreover, Alphabet, Amazon, Meta were far younger and smaller. If you ask me (and I’d be flattered if you did!) which of these companies will be dominant in 20 years, I’d pick Apple or Microsoft. (Says something, though I’m not sure what, that the oldest companies may also prove the most enduring.)9

But do you like like it?

We’re about to wrap up…stick with me!

In light of all of that, I think there is a good argument that Cook has been a fine successor. He has retained its hardware dominance, solidifying a massive customer base to which he can sell highly-profitable services.

HOWEVER, as I said at the start, Apple (and Jobs) is defined not by the money but by the impact on consumers. Jobs built products we love. Has Cook?

Remember that Cook monetizes his software/services through both consumers (subscriptions) and enterprises (ads/fees). But who loves him more? Enterprises.

Apple reported $78B in Services revenue last year. They don’t break it out, nor do any journalists or analysts, but I’ve tried to piece it together.

Key takeaway: While he says he wants to revolutionize trillion-dollar industries, Cook has made more money off of selling ads and access than selling consumer products/services – more money from third-party companies (53%) than from us (47%).

End of the line

How much further can Cook take this horse? Apple has endured the recent tech downturn better than any other company. Why do investors believe in this business model? Because they see even more potential for advertising and subscriptions.

Advertising

There is a lot of talk about Apple being an emerging advertising giant. But almost all of the ads revenue today comes from one product, App Store. What if Apple sells more ads across all of the other surfaces?

I mentioned Spotify and Apple Music above: 170M vs. 85M premium subscribers. But Spotify has an additional 236M MAUs who get ads. I think Apple’s approach to advertising is the most consumer oriented – compared to Google’s obnoxious blue links (now softened) or frustrating Hulu ads interrupting my episodes of 9-1-1.

For that reason, it is hard to imagine Apple offering free, ad-based subscriptions to Music or TV. It also seems at odds with the company’s efforts to provide (and tell people it provides) privacy and encryption. But we saw how quickly Netflix caved when it felt pressure. And Apple just hired a new ad exec, so stay tuned.

If Apple does decide to launch an ad-supported streaming service and paper its apps with ads, analysts think it could 4.3x revenue in a few years to $30B.

Subscriptions and Services

Subscriptions may hold still more potential. Even if Apple doesn’t launch new products, subscriptions could help the company charge us more for the existing ones.

I love this Morgan Stanley commentary:

“The average Apple user spent just $280 on hardware, and contributed just $69 to Apple Services revenue, in CY21. In other words, Apple users spent slightly less than $1 per day on all Apple products and Services in 2021. Compare that with your average daily coffee, lunch or transportation bill, and it's easy to see how the ceiling on Apple daily spend per user is well ahead of current trends (MS March 2022)

“In other words, Apple users spent slightly less than $1 per day on all Apple products and Services in 2021. Compare that with your average daily coffee…” — Morgan Stanley

It’s crazy to me that we spend on average $23/month on the iPhone hardware (another $10 on software/services), given what we pay for content: $10-15 for streaming, $24 on video games, $44 on Peloton.

It’s hard to raise prices without pissing off consumers (see: “inflation”), but subscription could be a way to disorient us and make it more palpable. Peloton equipment subscriptions cost $90-120!

Tim Cook is already on it, but the launch has been delayed, possibly coming this year.10

Yet, once more I say — not new products that excite us, just new ways to monetize existing ones.

Final thoughts: Revolutionizing vs. Monetizing

To recap: Cook has launched some mediocre services that we don’t really want. Who wants them? Advertisers.

All (3k words) of this is to say that Apple hasn’t done anything disruptive in a while, just annoying and replacing Netflix, Google, Spotify, Peloton.

Jobs revolutionized products; Cook monetizes them.

Here is where I think it gets even more funny (possibly alarming for investors). If you found anything above “revolutionary”, it was probably started by Jobs, not Cook.

In the final 18 months of his life, Jobs launched the App Store (including the fees that generated 75% of its revenue last year), Wallet (originally Passbook), AppleCare, and Siri.

Furthermore, iTunes did much of the heavy lifting for Music. Jobs had already launched TV and likely would’ve done Studies/TV+ very well, given he founded Pixar and was on the Board/largest shareholder of Disney.

Jobs had also started the Watch and knew it would be the gateway into healthcare. Just how far ahead did he see on that one?

As he was fighting cancer, Jobs was increasingly curious about medicine. In 2010, he acquired RareLight, the team that delivered the recent breakthrough. He was seven years behind Elizabeth Holmes but a decade ahead of the technology.

In fact, the entire Services bundle (now One) was started by Jobs…23 years ago! Originally, iTools, then MobileMe, users paid a fee for some basic services (email, Backup, Find My iPhone, Storage, etc.). It didn’t go particularly well.

It later became iCloud. All were predecessors to Apple One.

And, after all, the entire Services division is led by…SVP Eddy Cue – an Apple employee since 1989 and member of Jobs’s inner circle.

That isn’t to say that Cook doesn’t deserve a tremendous amount of credit for executing. I wrote previously about his incredible ability to streamline operations and navigate global politics.

But it does seem like a lot of Apple’s current success was set in motion by its founder. Cook’s success might be a “right place right time” situation.

Without the Apple Car, how will we get anywhere?

Absolutely Apple can keep expanding software and services. There is tremendous opportunity to replace the legacy businesses I mentioned at the start. And subscription hardware could get a lot more money out of us.

But for all of this to work, Apple needs to retain its position in hardware today. It can’t go the way of the car companies, annually tweaking their designs without revolutionizing the tech, only to be disrupted by Tesla. Samsung, Xiaomi, Google are not giving up.

In 12 years, Apple has delivered very modest improvements to the legacy products. The next lines – Homepod (already flopped once), AR/VR headset (not much buzz), and the Car (concerning reporting to date) – are Cook’s biggest test.

Can one of them disrupt our world the way Jobs did five times?

On the other hand, there has never existed a business moat as defensible as Apple’s – never a single company that built a massive hardware customer base, combined with an even larger software/services ecosystem…and $400B cash with the ability to cheaply raise more.

In the final part of this series, I’m going to look at how successfully the rest of Big Tech (Alphabet, Amazon, Microsoft, Meta) has launched new businesses, largely after their founders left – oh, and Zuck.

Mostly unrelated personal reflection

As I expand my readership to people who don’t know me outside of Substack, I’ll put these updates at the bottom to avoid scaring off new people. (If you read this far, hopefully you’re still interested.)

At my friend Hirsh’s suggestion, I started the new Ken Burns documentary about how the US responded to the Holocaust before entering the war. In summary: Hitler was (to some extent) okay with not murdering Jews if he could just get them to leave. Unfortunately for them, no one would take them (except places that Hitler subsequently invaded). And the documentary makes it very clear that newspapers and news reels widely publicized what was going on.

In particular, a new book by Dartmouth historian Matthew Delmont documents how black newspapers, like the Chicago Defender, identified the threat Hitler posed and covered it extensively beginning in the early ’30s. They knew what a leader and society were capable of: Hitler openly talked of his admiration of Jim Crow segregation.

Opposition to immigration, especially refugees, confounds me – particularly from the descendents of voluntary immigrants. I don’t think it requires the creative powers of Walt Disney (ha!) to empathize.

Moreover, never (like absolutely never) has history looked favorably on exclusion. (Actually, do Irish textbooks praise American xenophobia for not taking all of their starving? They wouldn’t have U2 or Stripe without us.) There are more displaced people today than at any point in history, 100M and growing. No doubt future generations will ask these same questions about us.

Anyway, as I wrote this, I thought about how every day we turn away Syrian immigrants like Steve Jobs’s father. If for no other reason other than that we’d rather be on iPhones than Blackberrys (Blackberries?) (who cares — CANADIAN!), don’t we want people like that?

But above all, when watching the documentary quote great Americans who were supportive of Germany (Henry Ford, Charles Lindbergh) or indifferent to the suffering/racist (Secretary of State Cordell Hull), I think the strongest argument for immigration is that there seems to be an inverse correlation (probably causation) between how long someone is here and how empathetic and decent they are.

Until Kevin McCarthy is willing to house people other than MTG, you can donate to the International Rescue Committee or UNHCR to help Turkey, Lebanon, Poland, and Colombia house them.

And thus ends my run for the 2024 Republican Presidential Primary. I endorse Jim Justice.

You have to give some credit to Roku. David wouldn’t have taken on three goliaths. But I think Apple’s struggles here highlight explain its other successes: we buy the products because of the ecosystem. TV (and TV+) don’t have great synergies with the rest of Apple products, nor do Homepod or Car. Maybe AR/VR will.

Apple is one of the few tech companies that does not provide free lunch to employees.

The Google/Apple deal is marketing. Now consider that the most expensive stadium naming in US history was $700M for the LA Lakers home for 20 years, now (still??): Crypto.com Arena. At $35M/year max, Google could’ve instead renamed 285 stadiums – every MLB, NFL, NBA/NHL/WNBA, skeeball venue in the country!

The Google deal is worth 2.5% of Apple revenue. Is there a cost? I can’t really see one. Maybe we use Google search in Safari and then we switch to using the Chrome, Gmail, Drive, Hangouts, Pixel phones? But aside from that, it is pure profit, 9% of Apple EBIT.

In 2020, the DOJ sued Google over this agreement, in part because a price that high is arguably anti-competitive: few others could pay it. That case is expected to go to trial this year.

[Read this part in a John Mulaney voice.]

There is a twist!

Earlier this year, the DOJ announced another lawsuit against Alphabet for monopolizing digital advertising – a case that could break up the company’s core businesses.

Google’s defense? That it is not a monopoly because there are other major players, namely: Microsoft, Amazon, and…Apple. It didn’t even mention the blues (Meta and Twitter).

Google helped make Apple into an advertising giant and is now arguing its creation is a challenger to its dominance!

Jobs loved music. There is a theory (which is sweet but wrong) that Jobs named the company in honor after Alan Turing, who many believe committed suicide by eating cyanide on an apple. He actually named it after Apple Records, the label created by the Beatles.

The 2015 Music launch was more complicated than just software and pricing – it required acquisition of Beats and negotiating rights and royalties with all the major labels. When Music launched, Taylor Swift publicly criticized Apple for not paying royalties during free trials. Six weeks later, after a peace brokered by Jimmy Iovine, Swift became Apple’s staunch defender: criticizing Spotify and praising Apple.

Other note: Can someone explain why content libraries for music, (audio)books, newspapers, podcasts are basically all the same and all have everything but TV/movies are not? Are the economics so batshit that Spotify could never justify exclusive rights to something? (There was a long period, until 2010, when Apple couldn't get the Beatles.) I understand that video streaming today now is end-to-end from producer to distributor, but why wasn’t content non-exclusive before when it was just Netflix vs. Hulu? That’s how it was in VHS/DVD rental shops. We’re basically back to the early days of cinema.

I don’t think Apple TV (the non-subscription store) makes much money. There are not many ads, and I’ll assume Apple content purchases are relatively modest, given the iTMS margins referenced above.

Payments seems more about staying competitive and the secondary benefits: need to have Pay/Wallet to match other smartphones, and Card (like any co-branded card) is good for driving customer loyalty. And probably they get some customer data, which is always good for…ads.

I may dig into this dynamic about old companies being better than new companies. It’s a popular hot take during the current tech correction, cynics saying no good company has been started since 2008.

It has already been seven years since a Bernstein analyst pitched the subscription hardware idea, at the time estimating it could help Apple reach a $1T valuation. I love that the analyst recirculated her report when Apple finally said it is taking her idea.